Free Stock Market Trading

- Adam Shaw - TheMoneyDoctor.TV

- Dec 14, 2025

- 5 min read

The Biggest Shake Up to ISAs, the Performance of Shares

& How to Avoid Trading Costs

The Chancellor’s Budget has triggered the biggest shake-up of ISAs in more than a decade – and it’s already changing how millions of people save.

Our money man Adam Shaw is here to help guide us through what the changes mean.

Q: So, what is the big change that has happened?

From 2027, anyone under 65 will see the annual cash ISA allowance cut from £20,000 to £12,000, while the full £20,000 limit remains only for those aged 65 and over.

So if you are under 65 you are being pushed to invest in riskier stock market related assets rather than safer deposit-like accounts.

And not only is there a shift in this rule – what’s also happening is that the government is complicating what was one of the few simple areas of savings, by putting in restrictions and tax on what it calls cash-like” investments inside stocks and shares ISA. So if you have cash sitting in an shares ISA waiting to be invested or Money Market funds of very short-term bond funds – these may be classed as cash and get taxed.

It's not just the loss of the tax-free shelter that’s an issue here. The finance world is already crazily complex and just getting to grip with things is a major turn-off for people. That’s why ISAs were such an island of calm in the troubled financial landscape. The recent changes just make things more complex and will no doubt discourage people from investing.

Ministers say the aim is to encourage more long-term investment in UK companies, rather than allowing savers to leave large sums sitting tax-free in cash. But critics warn the changes reduce flexibility, penalise cautious savers, and may push people into taking on more risk than they’re comfortable with.

Holly Mackay, the chief executive of the investment research website Boring Money, said: “In terms of where this could go wrong, I almost don’t know where to start. Cash-like investments are rife in stocks and shares Isas.”

This could cost an additional-rate taxpayer £9,349 in tax over ten years, according to the investment firm AJ Bell. Over five years, it would cost them £2,380. The analysis assumes they still wish to save £20,000 a year and put the remaining £8,000 every year into a savings account with 4 per cent interest.

Q: Is there a way round this?

Yes – at least in the short-term.

The changes, only come into effect in April 2027. So, you can still make use of the upper allowance if you put the money into the ISAs now.

The current Bank of England base rate is 4% (December 5th 2025). The Bank of England is told to keep inflation at 2% but they have not been able to do that. Inflation is now 3.6% (December 5th 2025). The Bank says it thinks inflation will fall and in which case they say they will probably be able to reduce interest rates.

Why is all that important?....because if that is true (and it’s a big if) then it might be worth considering locking in some savings at 4% whilst you can.

· Aldermore have a 2 year fixed ISA at 4.01%

· HTB Hampshire Trust Bank have a 2 year fixed ISA at 4.00%

· NatWest has a 2 year fixed ISA at 4.00%

· Royal Bank of Scotland has a fixed rate ISA at 4.00%

You can check the latest rates at MoneyFactsCompare.co.uk

Remember rates change all the time.

Q: Does the government’s move to push people into the stock market make sense and what are the advantages?

There is a logic to this. Although there is a risk to the stock market, over long-periods it tends to perform well and even better than a bank account.

Analysis by Schroders compares the return from cash and stock market performance between 1926 and 2022. They looked at any period in which stocks and cash did better than inflation. In every period they covered, shares outperformed cash by up to 37 percentage points.

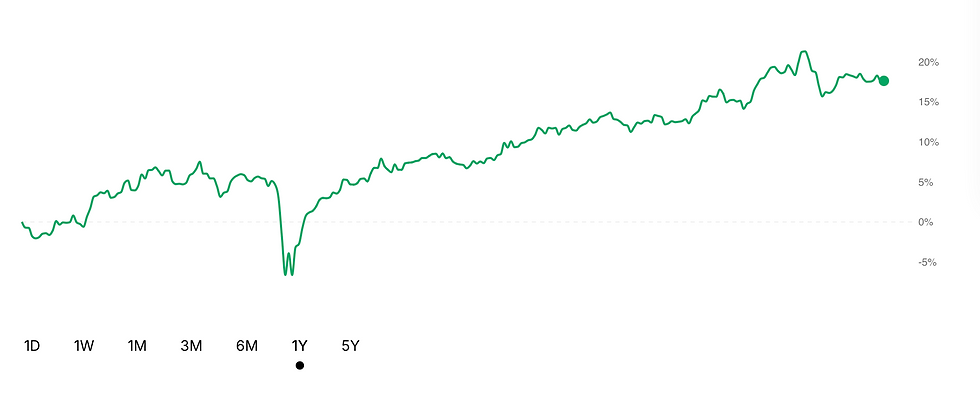

The chart below by NatWest compares the return from cash and stock market performance between 2003-23

Q: So should I jump in and out of the market – to avoid some of the big falls?

A: There is a natural appeal to this approach, especially as the market is very high at the moment and there is lots of talk of a market bubble about to burst.

But this is harder than it looks. Trying to jump in and out of the market is very difficult to time properly. That’s because the market’s performance is lumpy. It tends to jump in sudden movements. The investment group Fidelity estimate that if you missed just 5 of the best performing days in the US stock market last year, rather than just staying invested for the whole year, you would have lost a 37% gain.

Q: If I want to invest in a shares ISA – what is the cheapest way to do this?

The most straight forward way of investing in shares is to buy a tracker. It locks you into the performance of the index it is tracking but it is usually the cheapest way to invest.

There are 2 trading platforms which offer a buying and selling platform that doesn’t charge you anything for simple trades such as the ISA Tracker.

Trading 212 and FreeTrade. They are both very similar but I definitely found FreeTrade much easier to use and the whole interface of FreeTrade is more intuitive. The help desk on both is not brilliant but Trading 212 seemed worse in that when I tested it, the help desk insisted that they didn’t sell FTSE 100 Tracker ISAs, when that appears to be wrong.

If you are using FreeTrade it can still be less than straight forward to see what to do. Click the ISA button and that gives you access to all the ISA opportunities.

FTSE 100

Source: FreeTrade

The FTSE has risen 17% over the last year – so it might be dues for a correction – so there are real investment risks in the market and savers/investors should be aware that the risk of investing is high compared to safe investments in bank and building society accounts where the money is protected

JOIN THE MONEY DOCTOR - ADAM SHAW -

EVERY MONDAY ON TIMES RADIO AT 3:45PM

For more commentary follow me on Twitter/X and BlueSkySocial @adamshawbiz

Please remember everything on this site is journalist commentary and is not financial advice or guidance in anyway.

If you want to contact me - send an email via here