How to Trump-Proof Your Savings

- BetterAskAdam.com

- Mar 16, 2025

- 5 min read

Updated: Mar 17, 2025

Mr Unpredictable - President Trump, has created some wild and worrying times for people's savings.

His trade war has sent shock waves through the world's major economies and serious concerns for what happens to companies, interest rates and investment outlooks.

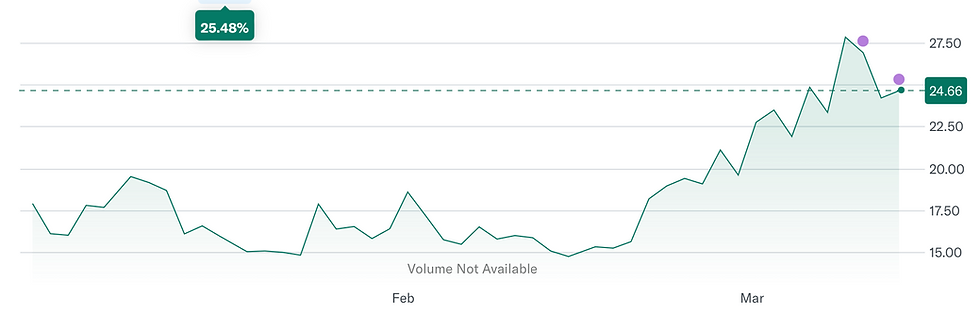

Q: How volatile has it got?

The clearest measure of just how crazy things are getting is a quick look at the Fear Index, also known as the VIX, (Volatility Index), which measures how much volatility professional investors think the S&P 500 index will experience over the next 30 days. - It’s a roller coaster ride that’s being expected.

THE FEAR INDEX

There are plenty of other ways of measuring the extent of investor's uncertainty. CNN’s Greed and Fear Index points toward some troubling times in investments, registering 'Extreme Fear'. The NFIB Small Business Uncertainty Index and the Baker, Bloom, and Davis Economic Policy Uncertainty Index for Trade Policy are two of he most cited measures. Both suggest the incertainty is at or near a high in their multi-decade histories.

THE FTSE TRIPS

Q: So what does that fear and uncertainty mean for investments?

The FTSE has taken a worrying tumble. Since the start of March the Index has lost almost 3% of its value. That equates to a loss of approximately £85bn in market capital for FTSE 100 companies and £9.5bn on the FTSE 250. But while not good, that has been much more resiliant than the US where the Dow Jones has lost about twice that ground in the same period - down around 6%. On the 12th March, the tech-focused Nasdaq suffered its worst single day since 2022, slipping 4%. Overall, the US market is said to have lost around $4trn since recent highs in February.

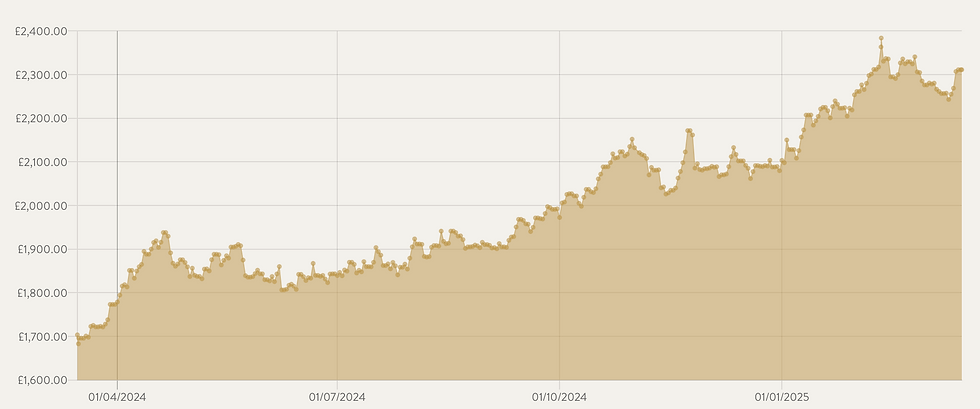

Q: Is there any good news?

A: Context is important here. Although the markets have tumbled - most investors should have had a good run and so this, in context of previous gains is not as dramatic as it might otherwise have been.

Even with the recent falls, the FTSE 100 is up around 11% since the start of 2024.

Time, not timing, is often the key to good investment strategies. It's almost impossible to know when the market turns and investors often jump into the market rides high and therefore buy at its most expensive and then panic when the market falls and sell when its least profitable to do so. There could be further falls to come, who knows, but resisting knee-jerk reactions and making investments that last - is probably a good thing to bear in mind.

Q: Are there any investments that have done well?

Gold has risen in value by 3% since early March. So, almost exactly what the FTSE has lost, gold has gained. In fact, gold prices have had a bit of a boom with prices rising over 30% in the past year.

There can be problems with buying gold, even if you decide that is something you want to do.

The traditional way to buy gold is to purchase coins or bars. You can do this through a specialist dealer or an online broker. In a Swiss airport, I even saw a gold vending machine. UK sovereign coins are also free of capital gains tax. But you have to store it somewhere and perhaps insure it and unlike shares or bank and building society accounts, it doesn't pay interest or dividends. Also, the price of various forms of gold may n ot match the market quoted price for bullion. It can also be highly volatile, peaking when things are most uncertain, just when you might buy gold, and falling when things settle down, just when you might want to sell it.

It might also be worth considering investing in a gold ETF which is a fund which invests in gold, so you get the gold investment without having to keep some bars of gold under the bed.

Q: What about defence shares?

The companies that make the weapons of war and deal in death and destruction have been doing very well. It is hard to support Ukraine's defence against Russia's invasion without offering support for the companies that make such defence possible. So conversations around the morality of investing in the defence sector, should be more nuanced and complex than they often are.

In investing terms, the sector has done very well. The main UK defence companies are:

BAE Systems

Rolls-Royce Group

QinetiQ

Babcock International

Serco Group

Babcock is one of the best performing shares in the sector. It's shares are up 50% since the start of the year.

Since the start of the year, BAE systems are up 42%. Rolls Royce are up 35%. QinetiQ (The real life Q from the James Bond books/movies) are up 5% after some recent falls and Serco which does a lot of other things as well as defence is up 2.5%.

Q: Is there anything easier to do to protect your savings - like getting a fixed-rate bank account?

If you want some certainty in your life, you could get the fixed rate 3-month bond from Raisin, which pays 4.07%

Investec has a 5-year fixed-rate bond which pays 4.3%

Q: What about UK government bonds - they are called gilt-edged because they are meant to be very safe - are they worth considering?

Gilts are traded on the London Stock Exchange and can be bought through investment platforms such as Hargreaves Lansdown, Interactive Investor or AJ Bell in the same way as you would buy a share.

You get an interest payment from the government, which is fixed and can last for 10 years or more - giving you some very long-term security.

The cost of borrowing for the government has been rising and because as a gilt investor, you are the one lending money to the government, it is you that is getting paid more.

Currently, gilts are paying around 4%. While not that eye-catching, it is not that bad and has a gold-edged security.

One thing to consider is buying gilts in the secondary market. They may pay a low rate of interest but are on sale below the original purchase price. If you buy them at the lower rate, you then get paid back the original higher price, when they mature. The advantage of this strategy is that you are making capital gains profit not income. Gilt investments are exempt from capital gains tax - so the profit you make is tax-free.

Q: Are there any general principles on how to safeguard your finances?

A: The biggest threat in a recession is the loss of income. So, it can be important to make sure you have emergency funds close to hand. In an uncertain world, being nimble is often a good idea.